Nitrogenous Fertilizer Market Size and Companies Analysis 2025- 2034

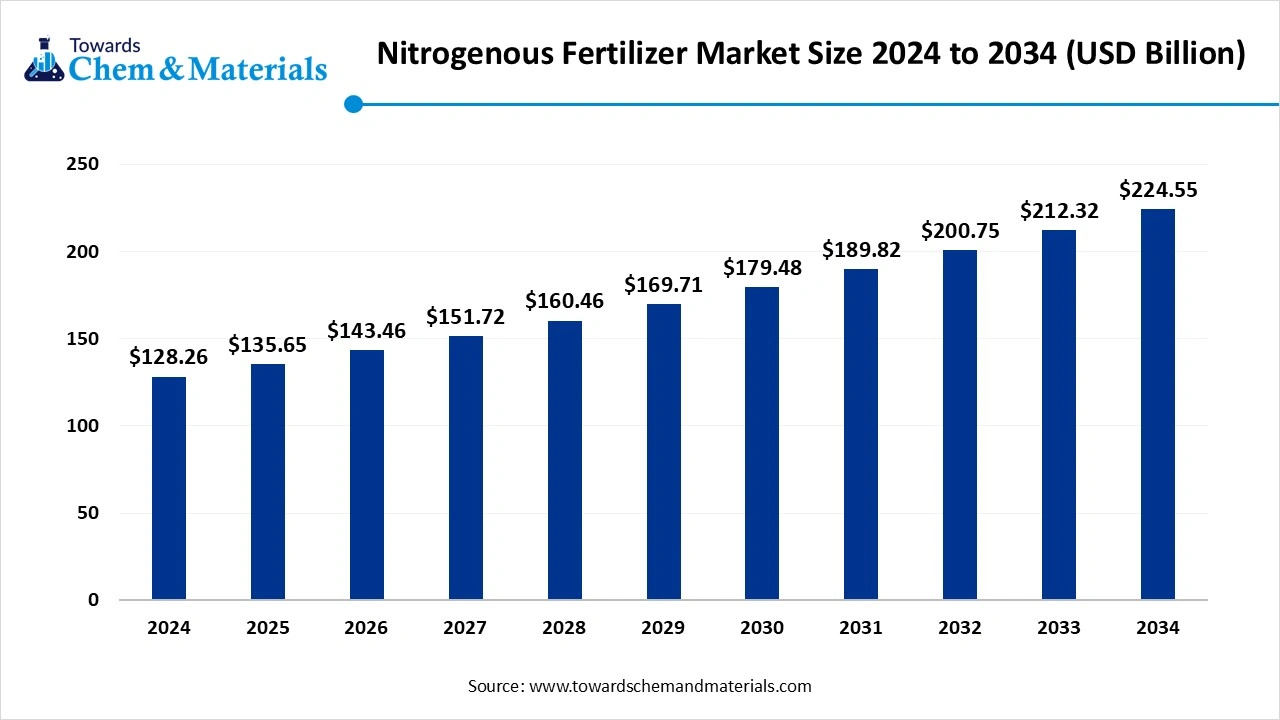

According to Towards Chemical and Materials, the global nitrogenous fertilizer market size is calculated at USD 135.65 billion in 2025 and is expected to surpass around USD 224.55 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.76% over the forecast period 2025 to 2034. the Key companies profiled are Kynoch Fertilizer; Sorfert; Bunge Ltd.; Nutrien Ltd.; Yara; Omnia Holdings Limited; Sasol; Aquasol Nutri; TriomfSA; Rolfes Agri (Pty) Ltd.; OCI Nitrogen; ICL Fertilizers; Eurochem Group AG; CF Industries Holdings Inc.; Koch Fertilizer; LLC; Hellagrolip SA; Coromandel International Limited; Haifa Group; Notore Chemical Industries Plc

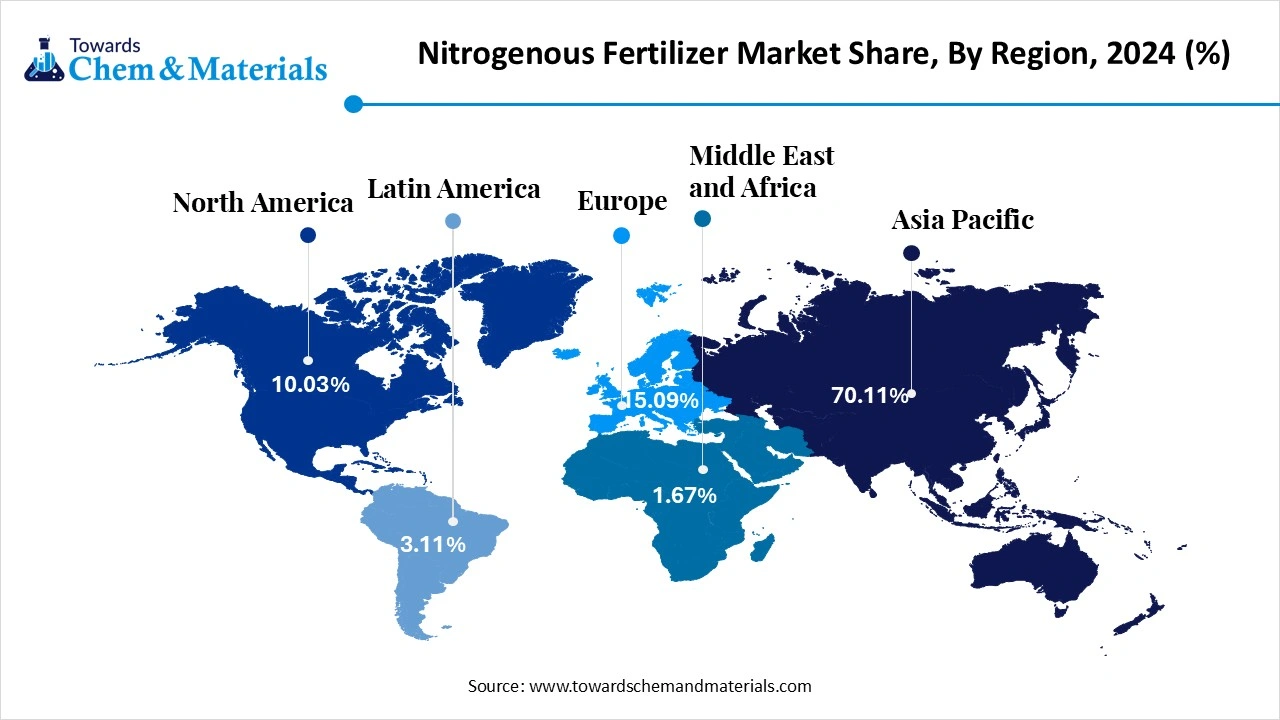

Ottawa, Nov. 03, 2025 (GLOBE NEWSWIRE) -- The global nitrogenous fertilizer market size was valued at USD 128.26 billion in 2024 and is anticipated to reach around USD 224.55 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.76% over the forecast period from 2025 to 2034. Asia Pacific dominated the Nitrogenous Fertilizer market with a market share of 70.11% in 2024. Rising global food demand and the need to enhance crop yields are driving the growth of the nitrogenous fertilizer market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5607

What is Nitrogenous Fertilizer?

The nitrogenous fertilizer market is witnessing robust growth driven by rising global food demand and the need to enhance crop productivity across diverse agricultural regions. These fertilizers play a vital role in promoting plant growth by providing essential nutrients that improve soil fertility and crop yield. The increasing adoption of modern farming techniques, supportive government initiatives, and ongoing advancements in precision agriculture are driving the market’s expansion. Moreover, growing awareness regarding sustainable agricultural practices and the rising need for efficient nutrient management are expected to further propel market development in the coming years.

Nitrogenous Fertilizer Market Report Highlights

- The Asia Pacific dominated the nitrogenous fertilizer market with the largest revenue share of 70.11% in 2024.

- The Europe market is expected to witness the fastest CAGR of 7.33% over the projected period.

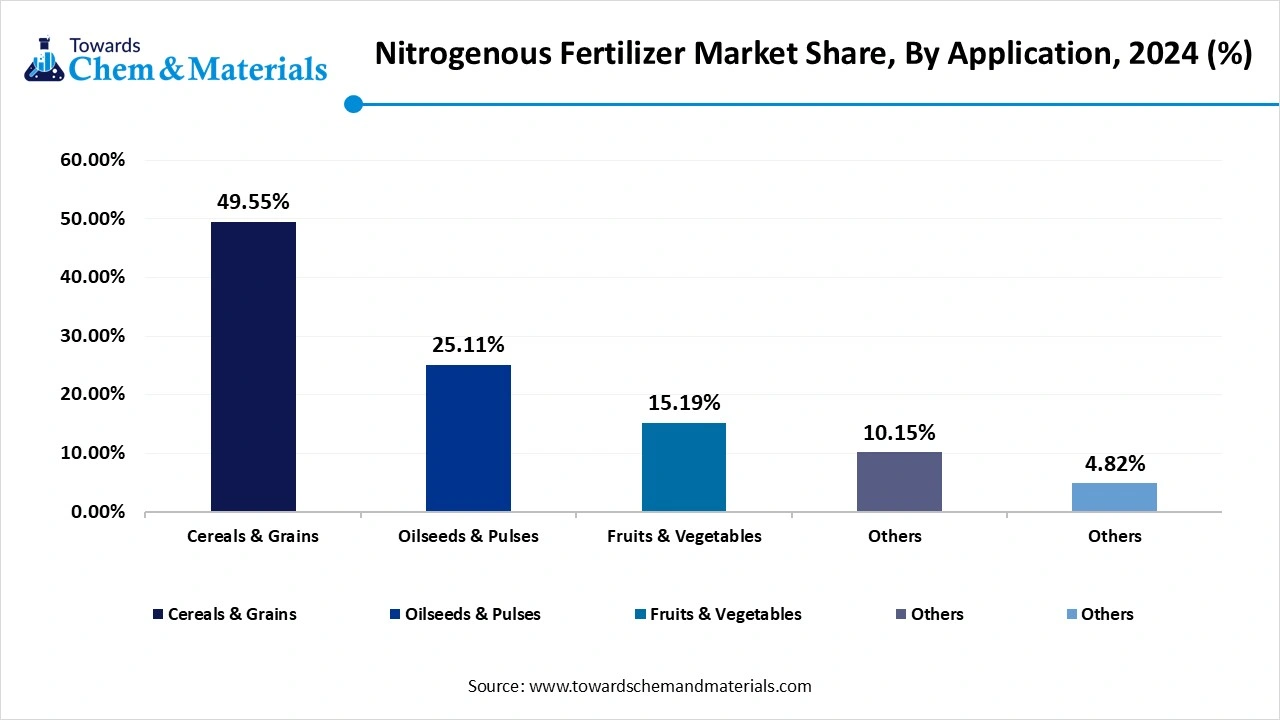

- By application, the cereals & grains segment held the highest revenue share of over 49.55% in 2024.

- By application, the oilseeds & pulses segment is expected to register the fastest CAGR of 6.11% during the forecast period,

- By product, the urea product segment accounted for the highest share of over 39.11% in terms of revenue in 2024.

- By product, the ammonia product segment stood in the second position in 2024 accounting for around 30.19% of the revenue share.

- By crop type, the cereals and grains segment held the highest revenue share of over 46% in 2024.

- By crop type, the oilseed and pulses segment is expected to register the fastest CAGR of 4.82% during the forecast period.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5607

Nitrogen Fertilizers Market: Why And How To Apply Sustainably

Nitrogen fertilizers have become an indispensable tool in the modern farmer’s arsenal, but their use is not without its challenges. While they promote plant growth, enabling farmers to maximize harvests, their improper usage can lead to environmental hazards like groundwater contamination and greenhouse gas emissions. Since nitrogen fertilizer overapplication not only wastes resources but also poses agricultural and ecological risks, striking the right balance is crucial. This article delves into the intricacies of nitrogen-based fertilizers so that farmers can harness their benefits while mitigating potential drawbacks. Equipped with this knowledge, growers can cultivate crops that are both sustainable and abundant.

Advantages And Disadvantages Of Using Nitrogen Fertilizers in Market

Nitrogen fertilizers are of interest to every farmer since they promote healthy plant growth and boost yields. However, there may be environmental costs associated with their industrial production and overuse. Gain a better understanding of nitrogen fertilizer benefits and risks so you can maximize the former and minimize the latter.

What Are The Benefits Of Nitrogen Fertilizers?

Nitrogen-based fertilizers, whether organic or synthetic, come in a wide variety of forms, so you may choose the one that’s best for your plants and the farm’s bottom line. The following are some of their primary benefits:

- provide crops with the most crucial nutrient required for the synthesis of chlorophyll, which powers the photosynthetic process in plants;

- boost crop protein content and yields;

- enhance the uptake of other nutrients, especially phosphorus, by plants ;

- a wide range of nitrogen fertilizer types allows you to customize the application to the individual demands of the farm;

- there is a choice between immediately available and slow-release options.

What Can Governments Do?

Governments face a tough challenge when it comes to managing nitrogen fertilizer use. Modern farming depends heavily on fertilizers like urea to produce enough food, so reducing their use without hurting crop yields is complicated. At the same time, keeping fertilizer prices low to help farmers—and prevent food prices from rising—puts a strain on national budgets. This issue is even more pressing in parts of West and Central Africa, where up to 90% of nitrogen fertilizers are imported, often from Russia.

In the short term, governments don’t have many easy solutions, but there are a few steps they can take to balance fertilizer costs and food security. One approach is to encourage farmers to use fertilizers more efficiently and responsibly. They can follow guidelines from the International Code of Conduct for the Sustainable Use and Management of Fertilizers, which promotes best practices for reducing fertilizer misuse and overuse. These include clear regulations on how fertilizers are sold, labeled, and distributed.

Another option is to support the use of organic fertilizers—like compost, manure, peat, seaweed, or guano—where possible. While these natural options are generally more sustainable, they also have downsides: they can be costlier, slower to release nutrients, and less effective in certain climates. Still, they can help improve soil health and reduce environmental harm while longer-term solutions are developed.

However, these short-term measures won’t be enough to fully replace synthetic nitrogen fertilizers, especially as the global population continues to grow toward 2050. In the long run, governments will need to invest in research, innovation, and new agricultural practices that can reduce dependency on synthetic fertilizers while maintaining high food production levels.

Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5607

Nitrogenous Fertilizer Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 59.40 billion |

| Revenue forecast in 2034 | USD 94.02 billion |

| Growth Rate | CAGR of 5.7% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2025 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in Thousand Tons, Revenue in USD million and CAGR from 2025 to 2035 |

| Segments covered | By Product Type, By Application, By Region |

| Regional scope | North America; Europe; Asia Pacific; CSA; MEA |

| Key companies profiled | Kynoch Fertilizer; Sorfert; Bunge Ltd.; Nutrien Ltd.; Yara; Omnia Holdings Limited; Sasol; Aquasol Nutri; TriomfSA; Rolfes Agri (Pty) Ltd.; OCI Nitrogen; ICL Fertilizers; Eurochem Group AG; CF Industries Holdings Inc.; Koch Fertilizer; LLC; Hellagrolip SA; Coromandel International Limited; Haifa Group; Notore Chemical Industries Plc 3M Company, Momentive Performance Materials Inc., BASF SE, DowDuPont Inc., Morgan Advanced Materials, Hanwha Group, PyroGenesis Canada Inc., Cytech Products Inc., Akzo Nobel N.V., Hexcel Corporation |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Nitrogenous Fertilizer Production

In value terms, nitrogenous fertilizer production dropped modestly to $X in 2024 estimated in export price. In general, the total production indicated a modest expansion from 2012 to 2024: its value increased at an average annual rate of X% over the last twelve-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, production decreased by X% against 2022 indices. The most prominent rate of growth was recorded in 2021 with an increase of X%. Over the period under review, global production hit record highs at $X in 2022; however, from 2023 to 2024, production stood at a somewhat lower figure.

Nitrogenous Fertilizer Exports

Exports

In 2024, shipments abroad of nitrogenous fertilizers (mineral or chemical) increased by X% to X tons for the first time since 2021, thus ending a two-year declining trend. The total export volume increased at an average annual rate of X% from 2012 to 2024; the trend pattern remained relatively stable, with only minor fluctuations being observed throughout the analyzed period. The most prominent rate of growth was recorded in 2021 when exports increased by X% against the previous year. As a result, the exports attained the peak of X tons. From 2022 to 2024, the growth of the global exports remained at a somewhat lower figure.

In value terms, nitrogenous fertilizer exports shrank to $X in 2024. Overall, exports continue to indicate a relatively flat trend pattern. The most prominent rate of growth was recorded in 2021 when exports increased by X%. Over the period under review, the global exports hit record highs at $X in 2022; however, from 2023 to 2024, the exports failed to regain momentum.

Exports by Country

In 2024, China (X tons), distantly followed by Russia (X tons) and the Netherlands (X tons) were the key exporters of nitrogenous fertilizers (mineral or chemical), together comprising X% of total exports. Belgium (X tons), the United States (X tons), Saudi Arabia (X tons), Egypt (X tons), Algeria (X tons), Germany (X tons) and Nigeria (X tons) held a relatively small share of total exports.

From 2012 to 2024, the biggest increases were recorded for Nigeria (with a CAGR of X%), while shipments for the other global leaders experienced more modest paces of growth.

In value terms, Russia ($X) remains the largest nitrogenous fertilizer supplier worldwide, comprising X% of global exports. The second position in the ranking was taken by China ($X), with a X% share of global exports. It was followed by Algeria, with a X% share.

From 2012 to 2024, the average annual growth rate of value in Russia totaled X%. The remaining exporting countries recorded the following average annual rates of exports growth: China (X% per year) and Algeria (X% per year).

Considerations For The Use Of Nitrogen Fertilizers In Agriculture

To get the most out of fertilizers with nitrogen, use them wisely. Otherwise, especially if there is excessive fertilization, the result may be a significant decrease in yield rather than an increase. First, take into account the following:

- Liquid fertilizing products are most effective when applied during active plant growth, as plants readily absorb them. However, improper or excessive application may lead to leaks and scorching of the plant roots.

- Dry or pelleted fertilizing products are best suited for less nutrient-hungry periods. But they might rest on the ground, making their volatile compounds more likely to evaporate.

Why Are Nitrogen Fertilizers a Problem?

Nitrogen fertilizers are essential for modern agriculture because natural soil nitrogen levels aren’t enough to support the world’s food demands. For more than a century, farmers have used synthetic fertilizers to fill this gap, helping to grow enough food for nearly 8 billion people.

However, these fertilizers come with serious environmental downsides. The excessive use of synthetic nitrogen fertilizers and pesticides releases nitrous oxide—a greenhouse gas about 300 times more potent than carbon dioxide—into the atmosphere. They also pollute rivers, lakes, and groundwater. When fertilizer runoff enters water bodies, it promotes excessive algae growth, which depletes oxygen levels in the water. This lack of oxygen suffocates fish and other aquatic life, disrupting entire ecosystems.

Nitrogen Fertilizer Sustainability: Where Do We Go From Here?

It is crucial to recognize that nitrogen fertilizers are not inherently harmful to the environment. However, if misused — which typically means overused — they can pose a risk. Negative effects arise when we apply fertilizer beyond what the soil and plants can handle: the surplus of nitrogen seeps into groundwater and streams or evaporates into the atmosphere. Conversely, if the fertilizer’s nitrogen content is entirely used for plant feeding, there won’t be any leftovers to contaminate the environment. This means that soil testing, field vegetation density analysis, and variable rate fertilization must become farmers’ best friends.

What are the Key Private-Industry Investments in the Nitrogenous Fertilizers Industry?

- Chambal Fertilizers & Chemicals Ltd. (CFCL) - Gadepan-III Plant: CFCL invested in a new, state-of-the-art urea plant at Gadepan, Rajasthan, under India's New Investment Policy. This greenfield project significantly boosts domestic urea production capacity, utilizing highly energy-efficient, latest-generation technology to meet India's growing agricultural demand and reduce import dependency.

- Matix Fertilizers and Chemicals Ltd. - Panagarh Plant: Matix set up a large-scale, private sector greenfield urea plant in Panagarh, West Bengal, which is one of the six new units commissioned under the Indian government's policy framework. This investment utilizes gas-based technology to add 1.27 million tonnes of urea capacity annually, helping to bridge the domestic supply gap.

- Koch Fertilizer, LLC. - Enid, Oklahoma Facility Investment: Koch invested approximately $150 million in its existing Enid, Oklahoma, nitrogen production facility to increase urea production and enhance reliability. This brownfield investment focuses on optimizing existing infrastructure and increasing the capacity to supply ammonia products to the North American market.

- Coromandel International Limited - Nano Fertilizers and Capacity Expansion: Coromandel is investing in backward integration projects and expanding its product portfolio, including developing nano-fertilizer production units. These investments aim to reduce import reliance, improve nutrient use efficiency, and tap into the growing market for sustainable and specialty nutrients.

- OCI N.V. - Low-Carbon and Renewable Ammonia Focus: OCI is making significant capital redirections towards low-carbon and renewable ammonia production pathways. These strategic investments aim to decarbonize production processes by exploring technologies like electrolysis powered by renewable energy, positioning the company for a sustainable energy transition in the industry.

- Nutrien Ltd. - Sustaining and Expanding Capacity: As a global leader, Nutrien continuously invests in sustaining and cautiously expanding its extensive nitrogen production capacity across North America and other regions. These ongoing capital expenditures ensure the reliability of its vast network of ammonia, urea, and UAN plants and optimize product distribution.

- Yara International ASA - Green Ammonia Projects and Acquisitions: Yara is actively investing in large-scale green ammonia projects and has made strategic acquisitions, such as Ecolan, a producer of recycled fertilizers. These moves highlight a focus on sustainable production methods and diversifying into new, environmentally friendly product lines.

- AGROFERT - Acquisition of Borealis AG Nitrogen Business: In March 2023, AGROFERT acquired the nitrogen business of Borealis AG to expand its footprint in the production and sale of nitrogen fertilizers. This M&A activity is a key private investment strategy aimed at consolidating market share and achieving greater operational scale in the European fertilizer market.

What Are the Major Trends in the Nitrogenous Fertilizer Market?

- Growing adoption of precision agriculture technologies to optimise nutrient delivery and minimise waste.

- Rising demand for eco-friendly and slow-release nitrogenous fertilisers is driven by environmental concerns and regulatory pressure.

- Increasing focus on specialty formulation and advanced products to improve nitrogen use efficiency.

- Strong emphasis on expanding production in key growth geographies and scaling manufacturing in regions with large agricultural bases.

How Does AI Influence the Growth of the Nitrogenous Fertilizer Industry in 2025?

Artificial intelligence (AI) is transforming the nitrogenous fertilizer industry by improving precision in nutrient management and enhancing overall agricultural productivity. Through data-driven insights, AI systems analyse soil composition, weather patterns, and crop requirements to determine the optimal amount and timing of nitrogen application, reducing nutrient losses and environmental impact. In addition, AI-powered predictive analytics and automation are streamlining fertilizer production, supply chain operations, and distribution efficiency, helping manufacturers meet growing agricultural demand while promoting sustainability and cost effectiveness.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5607

Nitrogenous Fertilizer Market Dynamics

Growth Factors

What’s Driving The Need For More Nutrient-Rich Crops?

As global food demand rises, farmers are increasingly turning to nitrogen-rich fertilizers to maintain high crop yields amid intensive agriculture and soil depletion. The urgency to replenish essential nutrients in soils has become a primary factor spurring the usage of nitrogen-based fertilizers.

How Is Technology Reshaping Fertiliser Application?

Advanced tools in precision agriculture now enable targeted nitrogen delivery based on real-time soil and crop data, boosting nutrient use efficiency and reducing waste. This shift toward smarter fertiliser management is reshaping demand dynamics in the nitrogenous fertiliser sector.

Market Opportunity

How Can Real-Time Soil Monitoring Create New Opportunities?

Smart sensors and IoT tools in agriculture enable farmers to track soil nutrients and apply nitrogen precisely when needed. This creates demand for advanced nitrogenous fertilisers suited to precision farming and digital platforms.

Can Better Soil Health Boost Fertiliser Demand?

The push to restore degraded soils is opening new opportunities for nitrogenous fertilisers that improve fertility and sustainability. Products combining nutrient efficiency with soil health benefits are gaining market attention.

Limitations & Challenges

- Environmental concerns, such as air and water pollution and soil degradation, hamper the growth of the market.

- The reliance on energy-intensive production and the vulnerability to fluctuations in raw material costs present a major challenge for the nitrogenous fertilizer industry.

Nitrogenous Fertilizer Market Segmentation Insights

Application Insights:

Why is the Cereals and Grains Segment Dominating the Nitrogenous Fertilizer Market?

The cereal & grains segment dominated the market due to its essential role in global food production. This segment drives most of the fertilizer demand as crops like rice, wheat, and corn require consistent nitrogen input for optimal yield. The growing population and increasing food consumption across major agricultural economies further amplify fertilizer use in cereal cultivation. Sustainable farming practices and government support for staple crop enhancement continue to reinforce this dominance.

The oilseeds & pulses segment is projected to grow at the fastest rate in the market. The rising demand for protein-rich and plant-based food products has boosted the cultivation of soybeans, lentils, and other pulses, driving fertilizer application in these crops. Farmers are increasingly adopting nitrogen-efficient products to improve soil health and productivity. In addition, technological advancements in fertilizer application and nutrient management are further accelerating growth in this segment.

Product Insights:

Why Does the Urea Segment Dominate the Nitrogenous Fertilizer Market?

The urea segment dominated the market owing to its widespread use, high nitrogen content, and cost-effectiveness. Urea remains a preferred choice among farmers globally for its efficiency in improving plant growth and enhancing yield. The segment benefits from easy availability and compatibility with multiple crop types. Moreover, ongoing advancements in urea production and distribution are helping sustain its dominance in both developed and developing agricultural economies.

The ammonia segment is set to experience the fastest rate of growth in the market. Its increasing demand as a raw material for producing other nitrogenous fertilizers, along with its direct use in intensive farming, fuels this growth. The adoption of sustainable ammonia production methods and the expansion of agricultural activities across emerging economies are contributing to its upward trajectory. Ammonia’s versatility and role in soil nutrient balance further strengthen its market potential.

Crop Type Insights

In 2024, cereals and grains led the market, capturing about 46% of the total share. These crops are the most widely cultivated and consumed worldwide, and they require careful nutrient management to achieve higher yields and boost farmers’ profitability. As a result, nitrogen-based fertilizers are heavily used in this segment. Commonly applied fertilizers for cereals and grains include urea, ammonium nitrate, and anhydrous ammonia.

The oilseeds and pulses segment held the second-largest market share and is projected to expand at a CAGR of approximately 4.82% between 2025 and 2034. The increasing focus on improving seed germination and promoting healthy canopy growth in pulse crops is expected to drive the demand for nitrogenous fertilizers throughout the forecast period.

Regional Insights

What Drives Dominance in the Asia Pacific Region?

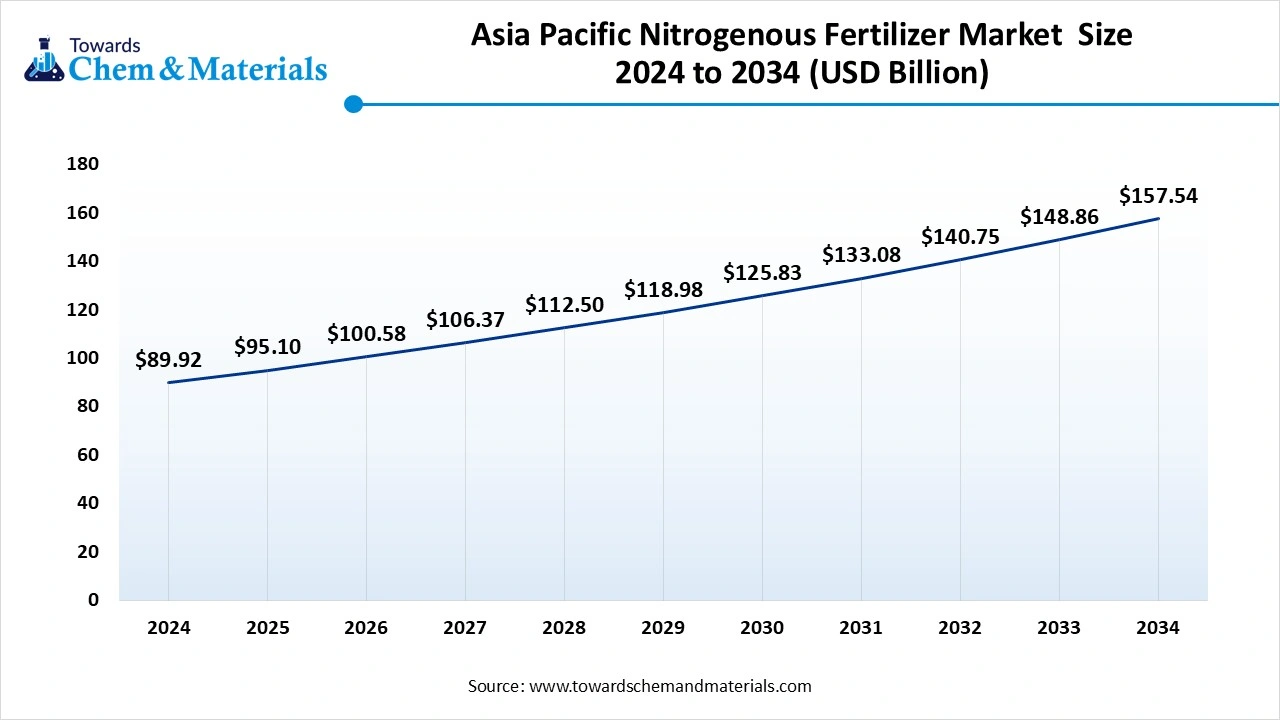

The Asia Pacific nitrogenous fertilizer market size was valued at USD 89.92 billion in 2024 and is expected to be worth around USD 157.54 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 5.77% over the forecast period 2025 to 2034. Asia Pacific dominated the market in 2024.

The Asia Pacific region dominates the global market due to its vast agricultural landscape, high population, and growing demand for food security. Countries within this region rely heavily on fertilizers to sustain the production of staple crops such as rice, wheat, and corn. The adoption of advanced farming techniques, coupled with government initiatives to increase agricultural productivity, continues to fuel fertilizer consumption. Moreover, expanding irrigation networks and awareness of soil fertility management further strengthen the region’s market presence.

China Nitrogenous Fertilizer Market Trends:

China plays a pivotal role in shaping the Asia Pacific market through its vast agricultural base and strong industrial infrastructure for fertilizer production. The country’s policies emphasize self-sufficiency in food production, encouraging extensive use of nitrogen-based fertilizers to boost crop yields. Additionally, China’s growing investment in sustainable and efficient fertilizer technologies reflects its efforts to balance productivity with environmental responsibility. Its large-scale manufacturing capacity and government-backed agricultural programs make it a central force in regional market growth.

What Is Driving Europe’s Rapid Growth in The Nitrogenous Fertilizer Market?

Europe is emerging as the fastest-growing region in the market, supported by the region’s increasing emphasis on sustainable agriculture and high-value crop production. The growing implementation of precision farming techniques, supported by digital tools and satellite-based monitoring, has improved the efficiency of fertilizer use across European farms. Additionally, the rising demand for locally produced food, the expansion of horticultural activities, and government policies promoting nutrient-efficient fertilizers are propelling market expansion. The focus on reducing nitrogen losses and adopting eco-friendly fertilizer formulations further enhances Europe’s growth prospects in the coming years.

France Nitrogenous Fertilizer Market Analysis:

France holds a prominent position in Europe’s market due to its extensive agricultural base, favourable climatic conditions, and strong infrastructure supporting large-scale farming. The country’s focus on optimizing soil fertility and improving crop innovative application techniques, such as festination and controlled release formulations. France’s policy framework also emphasizes environmental protection and resource efficiency, pushing demand for fertilizers that enhance yields while minimizing emissions and runoff.

Top Companies in the Nitrogenous Fertilizer Market & Their Offerings:

- Sorfert: Sorfert produces and exports nitrogenous fertilizers, primarily urea and ammonia.

- Nutrien Ltd.: Nutrien is a global producer and retailer of nitrogen-based products, including anhydrous ammonia, urea, UAN solutions, and ammonium sulfate.

- Omnia Holdings Limited: Omnia manufactures and supplies granular and specialty fertilizers in Southern Africa, including nitrate-based products like ammonium nitrate.

- Kynoch Fertilizer: Kynoch is an importer, blender, and retailer of customized nitrogenous plant nutrition solutions, including their enhanced efficiency KynoPlus® and liquid ranges.

- Bunge Ltd.: Bunge supplies and distributes a range of nitrogen-based fertilizers.

- Yara: Yara offers a wide range of nitrogenous fertilizers including urea, calcium ammonium nitrate (CAN), and ammonium nitrate (AN).

- Sasol: Sasol is a chemical company whose production likely includes components relevant to the fertilizer industry.

- TriomfSA: TriomfSA appears to be a defunct South African fertilizer company.

- OCI Nitrogen: OCI produces nitrogen fertilizers, including ammonia, urea, and UAN, with a focus on low-carbon and renewable ammonia-based products.

- Aquasol Nutri: Aquasol Nutri specializes in water-soluble fertilizers for precision agriculture.

- Rolfes Agri (Oty) Ltd.: Rolfes Agri offers agricultural inputs, including liquid and specialty fertilizers.

- ICL Fertilizers: ICL specializes in specialty mineral-based fertilizers, including advanced nitrogen formulations such as controlled-release and water-soluble fertilizers.

- CF Industries Holdings Inc.: CF Industries is a large manufacturer and distributor of nitrogen products globally, supplying ammonia, urea, and UAN solutions.

- Hellagrolip SA: Hellagrolip SA produces a variety of fertilizers, including nitrogenous, phosphatic, and potassium-based products.

- Eurochem Group AG: Eurochem produces and distributes nitrogen fertilizers, including ammonium nitrate, calcium ammonium nitrate, and urea.

- Koch Fertilizers, LLC: Koch Fertilizers supplies nitrogen fertilizers with a focus on efficiency-enhancing solutions and proprietary nitrogen stabiliser technology.

- Coromandel International Limited: Coromandel International offers nitrogenous fertilizers such as urea and ammonium phosphate sulfate.

- Notore Chemical Industries Plc: Notore is a leading fertilizer company in Africa, primarily engaged in the production of urea.

-

Haifa Group: Haifa Group specializes in specialty nitrogen-based fertilizers, focusing on highly efficient controlled-release and water-soluble products.

More Insights in Towards Chemical and Materials:

- Aquaculture Market : The global aquaculture market size is calculated at USD 310.66 billion in 2024, grew to USD 326.66 billion in 2025, and is projected to reach around USD 513.31 billion by 2034. The market is expanding at a CAGR of 5.15% between 2025 and 2034.

- Nanocatalysts Market : The global nanocatalysts market size was estimated at USD 3.16 billion in 2025 and is predicted to increase from USD 3.47 billion in 2026 to approximately USD 44.77 billion by 2034, expanding at a CAGR of 9.75% from 2025 to 2034.

- Agrochemicals Market : The global agrochemicals market size accounted for USD 285.36 billion in 2024 and is predicted to increase from USD 300.91 billion in 2025 to approximately USD 485.13 billion by 2034, expanding at a CAGR of 5.45% from 2025 to 2034.

- Specialty Fertilizers Market ; The global specialty fertilizers market volume was reached at 30.23 million tons in 2024 and is expected to be worth around 49.33 million tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 5.02% over the forecast period 2025 to 2034.

- Sulfur Fertilizer Market : The global sulfur fertilizer market size was approximately USD 4.95 billion in 2024 and is projected to reach around USD 8.02 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 4.95% between 2025 and 2034

- Fertilizers Market ; The global fertilizers market volume was 193.20 million tons in 2024 and is projected to grow from 199.19 million tons in 2025 to 262.18 million tons by 2034, exhibiting a CAGR of 3.10% during the forecast period.

- Phosphate Fertilizers Market : The global phosphate fertilizers market size is calculated at USD 70.11 billion in 2024, grew to USD 74.28 billion in 2025, and is projected to reach around USD 124.97 billion by 2034. The market is expanding at a CAGR of 5.95% between 2025 and 2034.

- Asia Pacific Nitrogenous Fertilizer Market : The Asia Pacific nitrogenous fertilizer market size was valued at USD 89.92 billion in 2024, grew to USD 95.11 billion in 2025, and is expected to hit around USD 157.57 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.77% over the forecast period from 2025 to 2034.

- Fertilizer Catalysts Market : The global fertilizer catalysts market size is calculated at USD 3.56 billion in 2025 and is expected to be worth around USD 4.75 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.25% over the forecast period 2025 to 2034.

- Controlled Release Fertilizers Market ; The global controlled release fertilizers market size was reached at USD 2.50 billion in 2024 and is expected to be worth around USD 4.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.02% over the forecast period 2025 to 2034.

- Asia Pacific Fertilizers Market : The Asia Pacific fertilizers market size was valued at USD 168.71 billion in 2024 and is anticipated to reach around USD 313.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.39% over the forecast period from 2025 to 2034.

- U.S. Nitrogenous Fertilizers Market ; The U.S. nitrogenous fertilizer market stands at 12,460.76 kilotons in 2025 and is forecast to reach 15,616.53 kilotons by 2034, growing at a CAGR of 2.85% from 2025 to 2034.

Nitrogenous Fertilizer Market Top Key Companies:

- Sorfert

- Nutrien Ltd.

- Omnia Holdings Limited

- Kynoch Fertilizer

- Bunge Ltd.

- Yara

- Sasol

- TriomfSA

- OCI Nitrogen

- Aquasol Nutri

- Rolfes Agri (Oty) Ltd.

- ICL Fertilizers

- CF Industries Holdings Inc.

- Hellagrolip SA

- Eurochem Group AG

- Koch Fertilizers, LLC

- Coromandel International Limited

- Notore Chemical Industries Plc

- Haifa Group

Recent Developments

- In October 2025, Petrobras' announcement that it will supply about one-fifth of Brazil’s nitrogenous fertilizer demand as it restarts operations at multiple local plants signals a major domestic production ramp-up. This could ease regional supply pressures and shift import dynamics in Latin America’s fertilizer market.

- In October 2025, the Rashtriya Chemicals and Fertilizers (RCF), together with National Fertilisers Limited and Indian Potash Limited (IPL), are planning a new urea manufacturing facility in Russia to secure long-term nitrogen fertilizer supply and reduce depended on volatile import markets.

Nitrogenous Fertilizer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Nitrogenous Fertilizer Market

By Product

- Urea

- Ammonium

- Methylene Urea

- Ammonium Nitrate

- Ammonium Sulfate

- Calcium Ammonium Nitrate

- Others

By Application

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Crop Type

- Oilseeds and pulses

- Fruits and vegetables

- Cereals and grains

- Others

By Form

- Liquid

- Dry

- Others (Granular and Pelleted)

By Mode of Application

- Soil

- Foliar

- Fertigation

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5607

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.