Generalized Myasthenia Gravis Market Outlook Shows Strong Momentum During the Forecast Period (2025–2034) Driven by Novel Immunotherapies | DelveInsight

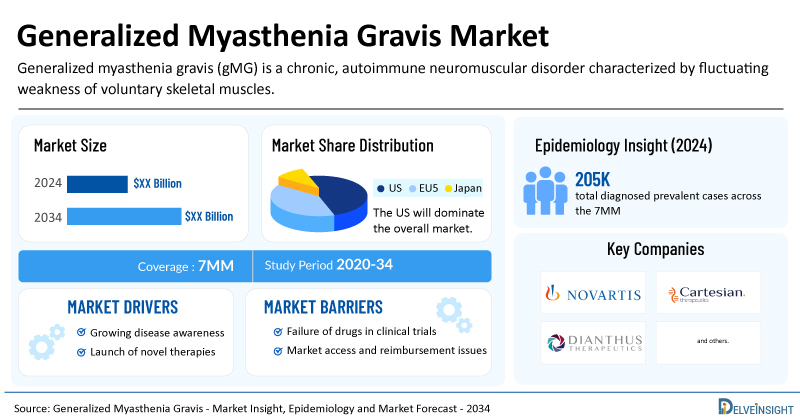

The generalized myasthenia gravis market in 7MM is expected to show positive growth during the forecast period (2025–2034), mainly driven by the anticipated launch of emerging therapies such as Descartes-08 (Cartesian Therapeutics), FABHALTA (iptacopan) (Novartis), Claseprubart (DNTH103) (Dianthus Therapeutics), and others, and the increasing incidence of gMG.

New York, USA, Jan. 14, 2026 (GLOBE NEWSWIRE) -- Generalized Myasthenia Gravis Market Outlook Shows Strong Momentum During the Forecast Period (2025–2034) Driven by Novel Immunotherapies | DelveInsight

The generalized myasthenia gravis market in 7MM is expected to show positive growth during the forecast period (2025–2034), mainly driven by the anticipated launch of emerging therapies such as Descartes-08 (Cartesian Therapeutics), FABHALTA (iptacopan) (Novartis), Claseprubart (DNTH103) (Dianthus Therapeutics), and others, and the increasing incidence of gMG.

DelveInsight’s Generalized Myasthenia Gravis Market Insights report includes a comprehensive understanding of current treatment practices, emerging generalized myasthenia gravis drugs, market share of individual therapies, and current and forecasted generalized myasthenia gravis market size from 2020 to 2034, segmented into leading markets (the US, EU4, UK, and Japan).

Generalized Myasthenia Gravis Market Summary

- The total generalized myasthenia gravis treatment market size is expected to grow positively by 2034 in the leading markets.

- The United States accounts for the largest market size of generalized myasthenia gravis, in comparison to EU4 (Germany, Italy, France, and Spain), the UK, and Japan.

- Based on DelveInsight's 2024 assessment, the 7MM had approximately 205,000 prevalent gMG cases, with projections indicating a growing trend and an estimated CAGR during the forecast period (2025−2034).

- Key generalized myasthenia gravis companies, including Novartis, Cartesian Therapeutics, Dianthus Therapeutics, and others, are actively working on innovative generalized myasthenia gravis drugs.

- Some of the key generalized myasthenia gravis therapies in clinical trials include FABHALTA (iptacopan), Descartes-08, Claseprubart (DNTH103), and others. These novel generalized myasthenia gravis therapies are anticipated to enter the generalized myasthenia gravis market in the forecast period and are expected to change the market.

Discover which generalized myasthenia gravis medications are expected to grab the market share @ https://www.delveinsight.com/sample-request/generalized-myasthenia-gravis-gmg-market?utm_source=globenewswire&utm_medium=pressrelease&utm_campaign=spr

Ramandeep Singh, Senior Consultant of Forecasting and Analytics at DelveInsight, commented: “A strong pipeline of innovative emerging therapies will boost the myasthenia gravis treatment market, providing patients with more choices.”

Key Factors Driving the Growth of the Generalized Myasthenia Gravis Market

- Rising gMG Prevalence: In 2024, the 7MM had approximately 205,000 diagnosed prevalent cases of gMG. These numbers are further expected to increase steadily, driven by population aging, better disease awareness and diagnosis, and improved survival.

- Advancements in Targeted and Biologic Therapies: Novel targeted treatments, such as complement inhibitors and FcRn antagonists, are transforming the therapeutic landscape by improving symptom control and treatment outcomes.

- gMG Therapies in Late-Stage Development: The gMG pipeline includes multiple encouraging late-stage programs, such as Descartes-08 from Cartesian Therapeutics, FABHALTA (iptacopan) by Novartis, and claseprubart (DNTH103) from Dianthus Therapeutics, alongside additional emerging therapies progressing through clinical development.

Generalized Myasthenia Gravis Market Analysis

- The myasthenia gravis (MG) treatment market is primarily driven by symptomatic therapies, particularly acetylcholinesterase inhibitors such as MESTINON.

- While effective for symptom control, symptomatic therapies rarely achieve sustained clinical remission, often requiring escalation to immunosuppressive treatment.

- First-line immunotherapy typically involves oral corticosteroids (prednisone or prednisolone), which demonstrate rapid clinical efficacy, especially at higher doses.

- Clinical improvement with corticosteroids is commonly observed within 2–4 weeks of treatment initiation.

- To minimize long-term steroid exposure and improve disease control, nonsteroidal immunosuppressive therapies (NSISTs) are widely used as steroid-sparing agents, reflecting the variability in response to steroid monotherapy. Commonly used NSISTs include:

- Antimetabolites: azathioprine, mycophenolate mofetil, methotrexate, cyclophosphamide

- Calcineurin inhibitors: tacrolimus and cyclosporine

- Although NSISTs may be used as monotherapy, their delayed onset of action typically requires 6–9 months to achieve meaningful therapeutic benefit.

- Immunomodulatory therapies, such as intravenous immunoglobulin (IVIg) and plasmapheresis (PLEX), are primarily employed as rescue treatments during myasthenic crises or acute disease worsening.

- IVIg and PLEX are also used as chronic therapies in patients who are refractory to or intolerant of conventional immunosuppressive regimens.

- Despite symptomatic improvement with standard immunosuppression, durable remission remains uncommon in MG.

- Approximately 15% of patients are treatment-refractory, showing inadequate response or intolerance to multiple immunosuppressive therapies.

- These patients often cycle through multiple treatment options, facing ongoing disease instability and cumulative immunosuppression-related adverse effects.

- In this setting, targeted biologic therapies, including ULTOMIRIS, VYVGART, and VYVGART HYTRULO (VYVDURA), have emerged as important treatment options for patients with refractory disease.

Learn more about the approved therapies for generalized myasthenia gravis @ Generalized Myasthenia Gravis Treatment Market

Generalized Myasthenia Gravis Competitive Landscape

The gMG clinical trial landscape features several promising late-stage candidates, including Descartes-08 (Cartesian Therapeutics), FABHALTA (iptacopan) (Novartis), Claseprubart (DNTH103) (Dianthus Therapeutics), along with other emerging therapies advancing through clinical development.

Novartis’ Iptacopan is an orally administered small-molecule inhibitor of complement Factor B, a central component of the alternative complement pathway. By preventing the formation of C3 and C5 convertases, it limits downstream complement activation and immune-mediated tissue injury. The therapy is currently in Phase III development for anti-AChR–positive generalized myasthenia gravis (gMG) patients who have shown insufficient response to second- or third-line standard treatments, addressing a significant unmet need in refractory disease. Novartis plans to submit Phase III data in gMG by 2027, with FABHALTA positioned as a potential first-in-class oral complement inhibitor in advanced gMG management.

Cartesian Therapeutics’ Descartes-08 represents the first RNA-based chimeric antigen receptor (CAR) T-cell therapy being developed for autoimmune diseases. The approach utilizes cytotoxic T cells engineered to selectively eliminate pathogenic plasma cells responsible for autoantibody production, with the therapy manufactured autologously from each patient’s blood. Descartes-08 has received Orphan Drug Designation from the U.S. Food and Drug Administration for the treatment of myasthenia gravis.

Dianthus Therapeutics’ Claseprubart (DNTH103) is a next-generation, subcutaneously delivered anti-FcRn monoclonal antibody developed for IgG-mediated autoimmune disorders, including gMG. It is designed to reduce pathogenic IgG levels while offering improved safety and tolerability relative to earlier FcRn-targeting therapies.

Ramandeep Singh concluded that the evolving gMG clinical trial landscape underscores a clear shift toward mechanism-driven, differentiated therapies aimed at addressing refractory disease and improving long-term disease control. Notably, iptacopan’s oral administration and upstream complement inhibition position it as a potentially first-in-class option that could redefine treatment sequencing in anti-AChR–positive gMG, while Descartes-08 introduces a paradigm-shifting, potentially disease-modifying approach by targeting autoantibody-producing plasma cells. Notably, iptacopan’s oral administration and upstream complement inhibition position it as a potentially first-in-class option that could redefine treatment sequencing in anti-AChR–positive gMG, while Descartes-08 introduces a paradigm-shifting, potentially disease-modifying approach by targeting autoantibody-producing plasma cells.

To know more about emerging drugs and pipeline assets for gMG, visit @ Generalized Myasthenia Gravis Medication

Recent Developments in the Generalized Myasthenia Gravis Market

- In January 2026, Dianthus Therapeutics reported that it participated in the 44th Annual J.P. Morgan Healthcare Conference.

- In December 2025, Johnson & Johnson reported European Commission approval of IMAAVY (nipocalimab), an FcRn-blocking monoclonal antibody, as an add-on therapy for gMG.

- In November 2025, Cartesian Therapeutics reported that enrollment is on track in the Phase III AURORA trial evaluating Descartes-08 in participants with myasthenia gravis.

- In October 2025, Dianthus Therapeutics reviewed new Phase II MaGic trial data for claseprubart in gMG, presented during the MGFA Scientific Session at the AANEM Annual Meeting.

- In September 2025, Dianthus Therapeutics reported positive Phase II MaGic trial results presented at AANEM showed that claseprubart delivered rapid, statistically significant, and clinically meaningful improvements across key gMG endpoints, with favorable tolerability and no drug-related serious adverse events.

- In May 2025, Cartesian Therapeutics reported the enrollment of the first participant in the Phase III AURORA trial of Descartes-08 in patients with myasthenia gravis.

What is Generalized Myasthenia Gravis?

Generalized myasthenia gravis (gMG) is a chronic, autoimmune neuromuscular disorder characterized by fluctuating weakness of voluntary skeletal muscles. It occurs when the immune system produces antibodies, most commonly against the acetylcholine receptor (AChR), or less frequently against MuSK or LRP4, that disrupt normal signal transmission at the neuromuscular junction. As a result, affected muscles fatigue easily and improve with rest. In gMG, muscle weakness extends beyond the eye muscles to involve bulbar, limb, respiratory, and trunk muscles, leading to symptoms such as difficulty speaking, chewing, swallowing, lifting objects, or breathing. The disease course is variable, ranging from mild weakness to severe, life-threatening exacerbations, and often requires long-term immunomodulatory and symptomatic treatment.

Generalized Myasthenia Gravis Epidemiology Segmentation

The generalized myasthenia gravis epidemiology section provides insights into the historical and current generalized myasthenia gravis patient pool and forecasted trends for the leading markets. In 2024, approximately 47% of gMG cases in Japan were male, while 53% were female. These numbers are expected to increase by 2034.

The generalized myasthenia gravis market report proffers epidemiological analysis for the study period 2020–2034 in the leading markets segmented into:

- Total Diagnosed Prevalent Cases of Myasthenia Gravis

- Total Diagnosed Prevalent Cases of gMG

- Age-specific Diagnosed Prevalent Cases of gMG

- Severity-specific Diagnosed Prevalent Cases of Myasthenia Gravis by MGFA Classification

- Gender-specific Diagnosed Prevalent Cases of gMG

- Total Diagnosed Prevalent Cases of gMG by Antibody Serology

Download the report to understand generalized myasthenia gravis management @ Generalized Myasthenia Gravis Treatment Options

| Generalized Myasthenia Gravis Market Report Metrics | Details |

| Study Period | 2020–2034 |

| Generalized Myasthenia Gravis Market Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Generalized Myasthenia Gravis Epidemiology Segmentation | Total Diagnosed Prevalent Cases of Myasthenia Gravis, Total Diagnosed Prevalent Cases of gMG, Age-specific Diagnosed Prevalent Cases of gMG, Severity-specific Diagnosed Prevalent Cases of Myasthenia Gravis by MGFA Classification, Gender-specific Diagnosed Prevalent Cases of gMG, and Total Diagnosed Prevalent Cases of gMG by Antibody Serology |

| Key Generalized Myasthenia Gravis Companies | Novartis, Cartesian Therapeutics, Dianthus Therapeutics, Alexion AstraZeneca Rare Disease, Argenx, and others |

| Key Generalized Myasthenia Gravis Therapies | FABHALTA (iptacopan), Descartes-08, Claseprubart (DNTH103), ULTOMIRIS, VYVGART, VYVGART HYTRULO/VYVDURA, and others |

Scope of the Generalized Myasthenia Gravis Market Report

- Generalized Myasthenia Gravis Therapeutic Assessment: Generalized Myasthenia Gravis current marketed and emerging therapies

- Generalized Myasthenia Gravis Market Dynamics: Conjoint Analysis of Emerging Generalized Myasthenia Gravis Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Generalized Myasthenia Gravis Market Unmet Needs, KOL’s views, Analyst’s views, Generalized Myasthenia Gravis Market Access and Reimbursement

Discover more about which companies are launching new gMG drugs @ Generalized Myasthenia Gravis Clinical Trials

Table of Contents

| 1 | Generalized Myasthenia Gravis Market Key Insights |

| 2 | Generalized Myasthenia Gravis Market Report Introduction |

| 3 | gMG Market Overview |

| 3.1 | Market Share (%) Distribution of gMG by Therapies in the 7MM in 2025 |

| 3.2 | Market Share (%) Distribution of gMG by Therapies in the 7MM in 2036 |

| 4 | Methodology of Epidemiology and Market |

| 5 | Executive Summary |

| 6 | Key Events |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Generalized Myasthenia Gravis Causes |

| 7.3 | Generalized Myasthenia Gravis Pathophysiology |

| 7.4 | Generalized Myasthenia Gravis Symptoms |

| 7.5 | Generalized Myasthenia Gravis Diagnosis |

| 7.6 | Treatment and Management of gMG |

| 8 | Epidemiology and Patient Population |

| 8.1 | Key Findings |

| 8.2 | Assumptions and Rationale: The 7MM |

| 8.2.1 | Total Diagnosed Prevalent Cases of Myasthenia Gravis |

| 8.2.2 | Severity-specific Diagnosed Prevalent Cases of Myasthenia Gravis by MGFA Classification |

| 8.2.3 | Total Diagnosed Prevalent Cases of gMG |

| 8.2.4 | Gender-specific Diagnosed Prevalent Cases of gMG |

| 8.2.5 | Age-specific Diagnosed Prevalent Cases of gMG |

| 8.2.6 | Total Diagnosed Prevalent Cases of gMG by Antibody Serology |

| 8.3 | Total Diagnosed Prevalent Cases of gMG in the 7MM |

| 8.4 | The US |

| 8.5 | EU4 and the UK |

| 8.6 | Japan |

| 9 | Generalized Myasthenia Gravis Patient Journey |

| 10 | Marketed Generalized Myasthenia Gravis Therapies |

| 10.1 | Key Cross Competition |

| 10.2 | ULTOMIRIS (Ravulizumab): Alexion AstraZeneca Rare Disease |

| 10.2.1 | Product Description |

| 10.2.2 | Product Profile |

| 10.2.3 | Regulatory Milestone |

| 10.2.4 | Other Developmental Activities |

| 10.2.5 | Clinical Trials Information |

| 10.2.6 | Safety and Efficacy |

| 10.3 | VYVGART (Efgartigimod alfa-fcab): Argenx |

| 10.4 | VYVGART HYTRULO/VYVDURA (Efgartigimod alfa and Hyaluronidase-qvfc): Argenx |

| List to be continued in the report… | |

| 11 | Emerging Generalized Myasthenia Gravis Therapies |

| 11.1 | Key Cross Competition |

| 11.2 | FABHALTA (iptacopan): Novartis |

| 11.2.1 | Drug Description |

| 11.2.2 | Other Developmental Activities |

| 11.2.3 | Clinical Trials Information |

| 11.2.4 | Safety and Efficacy |

| 11.2.5 | Analyst Views |

| 11.3 | Descartes-08: Cartesian Therapeutics |

| 11.4 | Claseprubart (DNTH103): Dianthus Therapeutics |

| List to be continued in the report… | |

| 12 | gMG Market: Seven Major Market Analysis |

| 12.1 | Key Findings |

| 12.2 | Key Generalized Myasthenia Gravis Market Forecast Assumptions |

| 12.3 | Attribute Analysis |

| 12.4 | Generalized Myasthenia Gravis Market Outlook |

| 12.5 | Total Market Size of gMG in the 7MM |

| 12.6 | Market Size of gMG by Therapies in the 7MM |

| 12.7 | The US Generalized Myasthenia Gravis Market Size |

| 12.7.1 | Total Market Size of gMG |

| 12.7.2 | Market size of gMG by Therapies |

| 12.8 | EU4 and the UK Generalized Myasthenia Gravis Market Size |

| 12.9 | Japan Generalized Myasthenia Gravis Market Size |

| 13 | Key Opinion Leaders' Views on gMG |

| 14 | Generalized Myasthenia Gravis Market SWOT Analysis |

| 15 | Generalized Myasthenia Gravis Market Unmet needs |

| 16 | Market Access and Reimbursement |

| 16.1 | The US |

| 16.2 | In EU4 and the UK |

| 16.3 | Japan |

| 16.4 | Market Access and Reimbursement of gMG |

| 17 | Bibliography |

| 18 | Acronyms and Abbreviations |

| 19 | Generalized Myasthenia Gravis Market Report Methodology |

Related Reports

Generalized Myasthenia Gravis Clinical Trial Analysis

Generalized Myasthenia Gravis Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key Generalized Myasthenia Gravis companies, including Biocon, Cartesian Therapeutics, UCB, Momenta Pharmaceuticals, HanAll Biopharma, Roche, Alexion, Novartis, Takeda, BioMarin, among others.

Myasthenia Gravis Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key myasthenia gravis companies, including Argenx, Alexion AstraZeneca Rare Disease, Johnson & Johnson, Immunovant, Roivant Sciences, Cartesian Therapeutics, Novartis, Merck KGaA, among others.

Myasthenia Gravis Clinical Trial Analysis

Myasthenia Gravis Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key myasthenia gravis companies including Harbour BioMed (Guangzhou) Co. Ltd., Kyverna Therapeutics, Cabaletta Bio, Takeda, Hoffmann-La Roche, Immunovant Sciences GmbH, Regeneron Pharmaceuticals, Novartis Pharmaceuticals, Janssen Research & Development, LLC, Momenta Pharmaceuticals, Inc., Amgen, Dianthus Therapeutics, Cartesian Therapeutics, COUR Pharmaceutical Development Company, Inc., Alexion Pharmaceuticals, Inc., among others.

Rheumatoid Arthritis Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key rheumatoid arthritis companies including R-Pharm, Taisho Pharmaceuticals, GlaxoSmithKline, Aclaris Therapeutics, Bristol Myers Squibb, Eli Lilly, Taiho Pharmaceutical, Cyxone, Gilead Sciences, Kiniksa Pharmaceuticals, Istesso, Applied Molecular Transport, Horizon Therapeutics, Genosco (Oscotec), Hope Biosciences, Abivax, Mesoblast, Akros Pharma, Japan Tobacco, Pfizer, Philogen, AbbVie, Pfizer, SynAct Pharma, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.